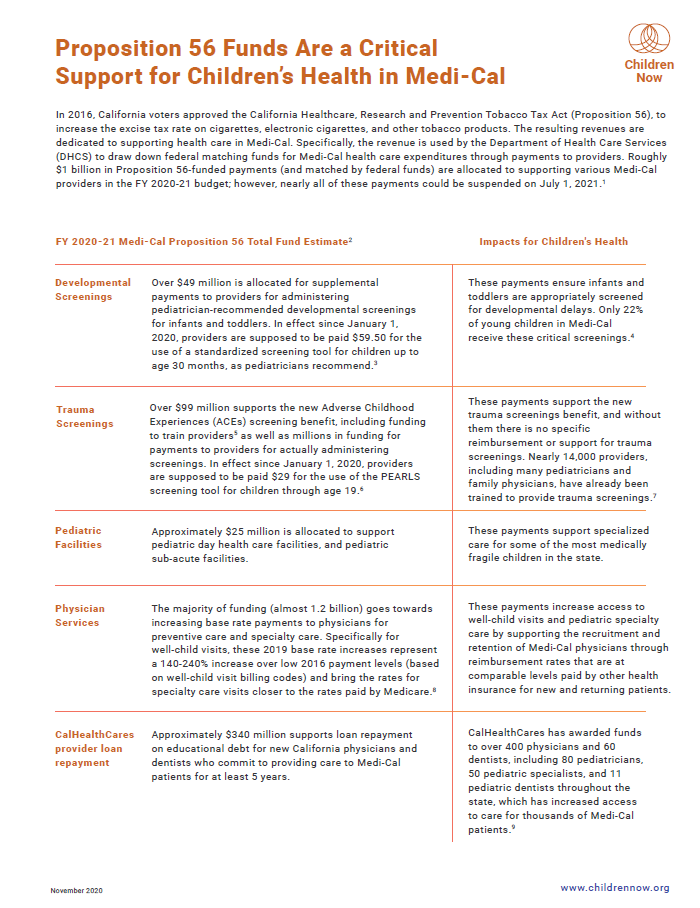

Proposition 56 Funds Are a Critical Support for Children’s Health in Medi-Cal

In 2016, California voters approved the California Healthcare, Research and Prevention Tobacco Tax Act (Proposition 56), to increase the excise tax rate on cigarettes, electronic cigarettes, and other tobacco products. The resulting revenues are dedicated to supporting health care in Medi-Cal. Specifically, the revenue is used by the Department of Health Care Services (DHCS) to draw down federal matching funds for Medi-Cal health care expenditures through payments to providers. Roughly $1 billion in Proposition 56-funded payments (and matched by federal funds) are allocated to supporting various Medi-Cal providers in the FY 2020-21 budget; however, nearly all of these payments could be suspended on July 1, 2021.1